Friday, February 27, 2009

Study Shows Disconnect Between African Americans' Attitudes and Actions When it Comes to Personal Financial Planning

African Americans are more optimistic about their financial future over the next year than the general population, but the majority of those responding acknowledge they don’t have a financial game plan and many don’t know where to start. A new survey of 1,200 participants commissioned by The Smiley Group and Nationwide Insurance shows 58 percent of African Americans expect their household situation to be better a year from now, compared to only 30 percent of the general population sharing similar optimism.

Study Shows Disconnect Between African Americans' Attitudes and Actions When it Comes to Personal Financial Planning

Source: Insurance News Net

Study Shows Disconnect Between African Americans' Attitudes and Actions When it Comes to Personal Financial Planning

Source: Insurance News Net

Lincoln National Wins $15M Jury Verdict in GMWB Patent Lawsuit

Lincoln National Life Insurance Company won a $13 million jury verdict on Feb. 13 in its patent infringement lawsuit against Transamerica Life Insurance Company, Western Reserve Life Assurance Company of Ohio, and Transamerica Financial Life Insurance Company.

This is the first time in recent memory that an insurance company has asserted its patent rights with respect to an insurance product and prevailed.

Lincoln National Wins $15M Jury Verdict in GMWB Patent Lawsuit

Source: Insurance News Net

This is the first time in recent memory that an insurance company has asserted its patent rights with respect to an insurance product and prevailed.

Lincoln National Wins $15M Jury Verdict in GMWB Patent Lawsuit

Source: Insurance News Net

New York Life's Chris Blunt Plans Expansion of VAs

When Chris Blunt was given the reins of The New York Life Insurance Company's new Retirement Income Security group in November, he took over a division that for the first time combined the firm's annuity, long-term care insurance and mutual fund distribution businesses...

New York Life's plans include a possible foray into variable annuities, an expansion into the defined contribution market and the potential for mutual fund acquisitions in the future. The projected growth comes as many of its publicly held peers are contracting or faltering beneath the weight of the global economic crisis...

Financial Planning: New York Life's Chris Blunt Plans Expansion of VAs

New York Life's plans include a possible foray into variable annuities, an expansion into the defined contribution market and the potential for mutual fund acquisitions in the future. The projected growth comes as many of its publicly held peers are contracting or faltering beneath the weight of the global economic crisis...

Financial Planning: New York Life's Chris Blunt Plans Expansion of VAs

S&P cuts 10 life insurers on higher loss assumptions

Standard & Poor's on Thursday cut its ratings on a slew of life insurers, including Metlife Inc and Hartford Financial Group, after it increased its loss assumptions for certain securities in relation to the insurers' capital adequacy...

Other insurers that were cut include [Hartford, Genworth Financial, Prudential Financial,] Americo Life Inc, Conseco Inc, Lincoln National Corp, Midland National Life Insurance Co, Pacific LifeCorp, Protective Life Corp, Security Mutual Life Insurance Co. of NY and Symetra Financial Corp...

Reuters: S&P cuts 10 life insurers on higher loss assumptions

Other insurers that were cut include [Hartford, Genworth Financial, Prudential Financial,] Americo Life Inc, Conseco Inc, Lincoln National Corp, Midland National Life Insurance Co, Pacific LifeCorp, Protective Life Corp, Security Mutual Life Insurance Co. of NY and Symetra Financial Corp...

Reuters: S&P cuts 10 life insurers on higher loss assumptions

Thursday, February 26, 2009

A Second Look at the First Wave of Baby Boomers and a New Look at the Youngest Boomers Shows Both Groups Behind on Their Savings Plans

A second look at the Baby Boomers who turned 62 last year and a new look at the Youngest Boomers, now turning 45, shows 46% of the oldest group and 57% of those in the younger, vastly larger group are not saving as much as they had hoped. The two groups, part of the same generation, but with 18 years between them, are in very different life stages and do not even agree on whether or not they are Boomers.

A Second Look at the First Wave of Baby Boomers and a New Look at the Youngest Boomers Shows Both Groups Behind on Their Savings Plans

Source: Yahoo! Finance

A Second Look at the First Wave of Baby Boomers and a New Look at the Youngest Boomers Shows Both Groups Behind on Their Savings Plans

Source: Yahoo! Finance

Inside AIG's Garage Sale

When American International Group announces earnings next week, Wall Street will expect a disaster. This week isn't so easy either. AIG is busy trying to sell off billions in assets to climb out of the onerous deal it made with Washington to escape collapse last fall.

Inside AIG's Garage Sale

Source: Forbes

Inside AIG's Garage Sale

Source: Forbes

In Challenging Economy, Northwestern Mutual Sets Recruiting Record

New financial representatives were recruited into Northwestern Mutual's financial network in record numbers for the second consecutive year during 2008 as 2,089 new full-time financial representatives began their careers with Northwestern Mutual.

In Challenging Economy, Northwestern Mutual Sets Recruiting Record

Source: Insurance News Net

In Challenging Economy, Northwestern Mutual Sets Recruiting Record

Source: Insurance News Net

Former Swisslife CFO accused of embezzlement

A former finance chief of insurance company Swisslife Holding has been charged with multiple counts of embezzlement and fraud, prosecutors in Zurich said Thursday.

Dominique Morax, who was Swisslife CFO from 1997 until 2002, is accused of involvement in alleged manipulation of the share price of Long Term Strategy AG, an investment company founded by Swisslife, district attorney Peter C. Giger said...

MSNBC: Former Swisslife CFO accused of embezzlement

Dominique Morax, who was Swisslife CFO from 1997 until 2002, is accused of involvement in alleged manipulation of the share price of Long Term Strategy AG, an investment company founded by Swisslife, district attorney Peter C. Giger said...

MSNBC: Former Swisslife CFO accused of embezzlement

AIG may face break-up

Restructuring talks are underway at stricken US insurance giant AIG which could see the company broken into three government-controlled units... The plan would split AIG into its Asian operations, its international life insurance business and its US personal lines business reported the Financial Times. There could also be a fourth unit comprised of the company's toxic assets.

Trouble with selling large assets may have prompted the plan. AIG's coveted Asian life insurance business AIA is currently on the block with three bidders in the running. The asset is expected to be valued at around US$20bn but is yet to receive a formal bid in an auction which is now in its last week...

The plan is being finalised and is expected to be announced next Monday when the company will also likely report a loss of US$60bn.

Thomson Merger News: AIG may face break-up

Trouble with selling large assets may have prompted the plan. AIG's coveted Asian life insurance business AIA is currently on the block with three bidders in the running. The asset is expected to be valued at around US$20bn but is yet to receive a formal bid in an auction which is now in its last week...

The plan is being finalised and is expected to be announced next Monday when the company will also likely report a loss of US$60bn.

Thomson Merger News: AIG may face break-up

A.M. Best Downgrades Issuer Credit Ratings of MetLife and Its Subs

A.M. Best Co. has downgraded the issuer credit rating (ICR) to "a-" from "a" of MetLife, Inc. (MetLife)...

Best also has downgraded the ICRs to "aa-" from "aa" and affirmed the financial strength rating of A+ (Superior) of MetLife's core life/health subsidiaries. Concurrently, A.M. Best has downgraded the debt ratings of MetLife and its subsidiaries. Additionally, A.M. Best has assigned a debt rating of "a-" to the $1.03 billion issue of 7.717 percent senior unsecured notes, Series B, due 2019 of MetLife. The outlook for all ratings is stable...

Trading Markets: A.M. Best Downgrades Issuer Credit Ratings of MetLife and Its Subs and Assigns Ratings to MetLife's Senior Debt Securities

Best also has downgraded the ICRs to "aa-" from "aa" and affirmed the financial strength rating of A+ (Superior) of MetLife's core life/health subsidiaries. Concurrently, A.M. Best has downgraded the debt ratings of MetLife and its subsidiaries. Additionally, A.M. Best has assigned a debt rating of "a-" to the $1.03 billion issue of 7.717 percent senior unsecured notes, Series B, due 2019 of MetLife. The outlook for all ratings is stable...

Trading Markets: A.M. Best Downgrades Issuer Credit Ratings of MetLife and Its Subs and Assigns Ratings to MetLife's Senior Debt Securities

Fidelity head slams "New Deal II" and Government Spending

Blames feds for crisis, derides U.S. spending

Fidelity’s Edward “Ned” Johnson jumped into the controversial debate over President Obama’s “New Deal II” and what Johnson called government “make-work projects.”

Without naming names, Johnson praised the administration’s effort to make economic recovery its top priority, saying it was “admirable.”

But Johnson, sounding like he’s never been a big fan of the original New Dealers from the 1930s, warned of too much government involvement in the economy and indicated Fidelity is beefing up its government-affairs unit to fend off possibly burdensome new regulations...

Boston Herald: Fidelity head slams "New Deal II" and Government Spending

Fidelity’s Edward “Ned” Johnson jumped into the controversial debate over President Obama’s “New Deal II” and what Johnson called government “make-work projects.”

Without naming names, Johnson praised the administration’s effort to make economic recovery its top priority, saying it was “admirable.”

But Johnson, sounding like he’s never been a big fan of the original New Dealers from the 1930s, warned of too much government involvement in the economy and indicated Fidelity is beefing up its government-affairs unit to fend off possibly burdensome new regulations...

Boston Herald: Fidelity head slams "New Deal II" and Government Spending

Wednesday, February 25, 2009

Individual Life Sales Saw Q4 Drop

Economic clouds seem to be hovering over yet another line of insurance industry business. New annualized premium for individual life insurance saw a 14% drop in the fourth quarter of 2008, ending the year with an overall 7% decline, according to LIMRA’s quarterly sales survey.

The fourth quarter marked the single sharpest decline in premium since the fourth quarter of 1951, according to LIMRA International, a Windsor, Conn. research, consulting and professional development organization. The overall decline for the year erased the strong 7% gain of the previous year, and was the largest one-year decline in LIMRA’s records...

INN: Individual Life Sales Saw Q4 Drop

The fourth quarter marked the single sharpest decline in premium since the fourth quarter of 1951, according to LIMRA International, a Windsor, Conn. research, consulting and professional development organization. The overall decline for the year erased the strong 7% gain of the previous year, and was the largest one-year decline in LIMRA’s records...

INN: Individual Life Sales Saw Q4 Drop

Hartford Financial President to "Retire"

Hartford Financial Services Group Inc. President and Chief Operating Officer Thomas Marra will retire in July as part of a "mutually agreed separation," becoming the second high-level executive to leave the company since the financial crisis hit the insurance industry last autumn...

In early October, Hartford announced the appointment of a new chief investment officer on the same day that the company announced a $2.5 billion capital infusion from German insurer Allianz SE to shore up its balance sheet... That executive change came roughly three weeks before the company posted a $2.6 billion third-quarter loss that showed some of the steepest investment-portfolio losses of the major life insurers. The company followed that up with a $806 million loss in the fourth quarter on more investment woes.

Hartford said Wednesday in a filing with the Securities and Exchange Commission that Mr. Marra, a 29-year veteran of the company who assumed the roles in June 2007, will retire effective July 3 and leave the company's board immediately...

WSJ: Hartford Financial President to "Retire"

In early October, Hartford announced the appointment of a new chief investment officer on the same day that the company announced a $2.5 billion capital infusion from German insurer Allianz SE to shore up its balance sheet... That executive change came roughly three weeks before the company posted a $2.6 billion third-quarter loss that showed some of the steepest investment-portfolio losses of the major life insurers. The company followed that up with a $806 million loss in the fourth quarter on more investment woes.

Hartford said Wednesday in a filing with the Securities and Exchange Commission that Mr. Marra, a 29-year veteran of the company who assumed the roles in June 2007, will retire effective July 3 and leave the company's board immediately...

WSJ: Hartford Financial President to "Retire"

AnnuitySpecs.com Releases Fourth Quarter, 2008 Indexed Sales Results

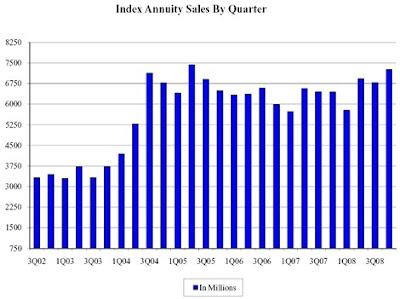

Fifty-nine indexed annuity carriers participated in the 46th edition of the Advantage Index Sales & Market Report, representing 99% of indexed annuity production. Total fourth quarter sales were $7.2 billion, up 12.7% from the same period last year. As compared to the previous quarter, sales were up 6.7%. “People are looking for a way to protect their dollars, and indexed annuities are the ‘safe money place’ of choice,” said Sheryl J. Moore, President and CEO of AnnuitySpecs.com. “Rest assured when I tell you that 2009 sales of indexed annuities will be a record! Who better to serve the safe money needs of Americans than insurance agents selling these fixed insurance products?” Total 2008 sales were $26.7 billion, the second-highest sales year for the product line (2005 sales were a record at $27.2 billion).

Fifty-nine indexed annuity carriers participated in the 46th edition of the Advantage Index Sales & Market Report, representing 99% of indexed annuity production. Total fourth quarter sales were $7.2 billion, up 12.7% from the same period last year. As compared to the previous quarter, sales were up 6.7%. “People are looking for a way to protect their dollars, and indexed annuities are the ‘safe money place’ of choice,” said Sheryl J. Moore, President and CEO of AnnuitySpecs.com. “Rest assured when I tell you that 2009 sales of indexed annuities will be a record! Who better to serve the safe money needs of Americans than insurance agents selling these fixed insurance products?” Total 2008 sales were $26.7 billion, the second-highest sales year for the product line (2005 sales were a record at $27.2 billion).It is worth mentioning that Aviva still holds the #1 position in the market; they even increased their market share by 2% since last quarter to an astounding 31% market share. No carrier has done the same level of IA production in a single quarter since 2nd quarter, 2005. American Investors Income Select Bonus is the #1 selling indexed annuity in the market for the second consecutive quarter. It is also interesting to note that nearly 56% of all indexed annuity sales for the quarter were through Iowa-domiciled companies...

INN: AnnuitySpecs.com Releases Fourth Quarter, 2008 Indexed Sales Results

Lincoln National wins verdict in VA patent dispute

Insurer and investment manager Lincoln National Corp. said Tuesday a jury sided with the company in a patent dispute with a Dutch company that owns U.S. insurer Transamerica.

A jury that considered a lawsuit involving a computerized method of administering variable annuities found Lincoln's patent valid in a Feb. 13 verdict, ruling in favor of Lincoln National Life Insurance Co. and against three U.S. companies owned by Aegon NV, Philadelphia-based Lincoln said... The companies are Transamerica Life Insurance, Transamerica Financial Life Insurance Co. and Western Reserve Life Assurance Co. of Ohio...

Forbes: Lincoln National wins verdict in patent dispute

A jury that considered a lawsuit involving a computerized method of administering variable annuities found Lincoln's patent valid in a Feb. 13 verdict, ruling in favor of Lincoln National Life Insurance Co. and against three U.S. companies owned by Aegon NV, Philadelphia-based Lincoln said... The companies are Transamerica Life Insurance, Transamerica Financial Life Insurance Co. and Western Reserve Life Assurance Co. of Ohio...

Forbes: Lincoln National wins verdict in patent dispute

‘Dead Peasant’ Policies: The Next Big Thing in Insurance Litigation

Ever heard of “dead peasant” insurance policies? We hadn’t either, until recently. In a nutshell, they’re often secret insurance policies taken out by companies on unwitting employees, which can yield sizable corporate tax breaks.

They’re also, it turns out, spawning a good deal of litigation. The National Law Journal recently ran a piece on lawsuits related to the policies. And in today’s WSJ, reporter Ellen Schultz weighs in — focusing largely on an odd Texas lawsuit...

WSJ Law Blog: ‘Dead Peasant’ Policies: The Next Big Thing in Insurance Litigation

They’re also, it turns out, spawning a good deal of litigation. The National Law Journal recently ran a piece on lawsuits related to the policies. And in today’s WSJ, reporter Ellen Schultz weighs in — focusing largely on an odd Texas lawsuit...

WSJ Law Blog: ‘Dead Peasant’ Policies: The Next Big Thing in Insurance Litigation

Tuesday, February 24, 2009

Life Insurers Continue Ratings Drop

The beleaguered life insurance industry continues to take a beating from the rating agencies as Genworth Financial and Prudential Financial both were both downgraded.

Prudential’s downgrade by Fitch Ratings was especially harmful as the second-largest insurer lost eligibility for the U.S. commercial paper program, reducing the company’s access to short-term debt markets. Both Genworth and Hartford Financial Services have already lost access to the commercial paper program because of downgrades...

Financial Planning: Life Insurers Continue Ratings Drop

Prudential’s downgrade by Fitch Ratings was especially harmful as the second-largest insurer lost eligibility for the U.S. commercial paper program, reducing the company’s access to short-term debt markets. Both Genworth and Hartford Financial Services have already lost access to the commercial paper program because of downgrades...

Financial Planning: Life Insurers Continue Ratings Drop

AIG Gets Bids for Life Insurance Unit

American International Group received bids from MetLife and Axa SA for a life-insurance unit spanning more than 50 countries, a sale that could mark the biggest step yet in the firm's dismantling, Bloomberg reports, citing people familiar with the situation.

AIG Gets Bids for Life Insurance Unit

Source: The Street

AIG Gets Bids for Life Insurance Unit

Source: The Street

Transamerica Launches Financial Recovery Action Plan for Retirement Plan Participants Hit by Economic Crisis

In challenging economic times, it's increasingly important for investors to assess their financial situation and take back control of their retirement savings strategy. Recognizing this growing need, Transamerica Retirement Services has launched a program to help retirement plan participants weather the financial storm, create a successful investment plan and regain confidence in their financial future. This new program, named "The RECOVER Plan by Transamerica," is designed to help participants understand the causes of the economic situation, the cycles of the financial markets, and how to evaluate and improve their prospects for retirement.

Transamerica Launches Financial Recovery Action Plan for Retirement Plan Participants Hit by Economic Crisis

Source: Market Watch

Transamerica Launches Financial Recovery Action Plan for Retirement Plan Participants Hit by Economic Crisis

Source: Market Watch

Jefferson National Launches Online Communities to Help Americans Save More for Retirement

On a mission to help Americans save more for retirement, Jefferson National has launched two new online communities for consumers and advisors at: www.annuityrescuecenter.com and www.poweroftaxdeferral.com. The communities provide a forum of resources including online tools, articles from industry experts, commentary from seasoned investors, and a blog where members share what they learn.

Jefferson National Launches Online Communities to Help Americans Save More for Retirement

Source: Earth Times

Jefferson National Launches Online Communities to Help Americans Save More for Retirement

Source: Earth Times

A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

2008 was among the worst in memory for life insurers’ operating performance—the key drivers being substantial realized and unrealized losses on investment portfolios, higher costs of capital and a declining revenue base. These trends clearly are continuing and could deepen well into 2009 and beyond. A.M. Best Co.’s recently issued special report, “Life/Annuity Review & Preview 2009: U.S. Life Insurers Hunker Down As Market Turmoil Continues,” expresses the rating agency’s current perspective on the industry.

On September 18, 2008, A.M. Best revised the outlook on the U.S. life/annuity segment to negative from stable, citing uncertainty in terms of the future direction of the economy, real estate values, interest rates, equity markets—both domestically and globally—and liquidity. Specific areas of emerging investment risk cited included a number of previously stable investment classes—commercial mortgages (both direct loans and securitizations), asset-backed securities (e.g., credit card receivables and auto loans), alternative investments (such as limited partnerships and hedge funds) as well as prime residential mortgage-backed securities. Moreover, continued weakness in the equity markets translated to reduced fees for asset-based products, raising the potential for DAC write-offs and increased hedging costs for writers of variable annuities and fixed-indexed products. The severe decline and volatility in the equity markets has caused capital strain for many life companies, especially the large variable annuity writers.

Since that time, macroeconomic conditions have continued to deteriorate and many of these predictions have come to fruition. A.M. Best has witnessed extraordinary steps taken by governments globally to combat this unprecedented economic downturn. Nevertheless, despite these efforts, uncertainty continues regarding the depth and duration of the lingering financial crisis. Recently, U.S. equity markets have again re-touched November 2008 bear market lows. Clearly, these negative macroeconomic factors are having an adverse impact on life insurers’ balance sheet strength and operating performance.

Over the last several months, A.M. Best has taken a number of negative rating actions in the life insurance sector, triggered primarily by investment concerns. A.M. Best expects the pace of these rating actions to accelerate as it reviews the year-end results for life and annuity companies. It is our expectation that a significant number of negative rating actions—including downgrades of issuer credit ratings (ICR) and financial strength ratings (FSR) as well as outlook revisions—will occur as a result of this review. A.M. Best has observed a number of disconcerting trends including:

* Escalating credit impairments and write-downs in investment portfolios

* High concentration of real-estate linked assets

* Significant levels of unrealized losses relative to capital

* Reduced levels of tangible equity and lower financial flexibility

* Write-offs of goodwill and DAC

* Weakened fixed charge coverage and higher financial leverage ratios

* Deterioration in earnings in core business lines

* High exposure to equity market volatility, translating into increases in variable annuity reserves and capital combined with declining fee income and assets under management

* Lower sales in certain product lines

* Higher levels of complexity in product design, capital structures and accounting treatment, which at times can mask true economic risks

* Pressure from non-insurance subsidiaries on the enterprise’s earnings and capital...

Business Wire: A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

On September 18, 2008, A.M. Best revised the outlook on the U.S. life/annuity segment to negative from stable, citing uncertainty in terms of the future direction of the economy, real estate values, interest rates, equity markets—both domestically and globally—and liquidity. Specific areas of emerging investment risk cited included a number of previously stable investment classes—commercial mortgages (both direct loans and securitizations), asset-backed securities (e.g., credit card receivables and auto loans), alternative investments (such as limited partnerships and hedge funds) as well as prime residential mortgage-backed securities. Moreover, continued weakness in the equity markets translated to reduced fees for asset-based products, raising the potential for DAC write-offs and increased hedging costs for writers of variable annuities and fixed-indexed products. The severe decline and volatility in the equity markets has caused capital strain for many life companies, especially the large variable annuity writers.

Since that time, macroeconomic conditions have continued to deteriorate and many of these predictions have come to fruition. A.M. Best has witnessed extraordinary steps taken by governments globally to combat this unprecedented economic downturn. Nevertheless, despite these efforts, uncertainty continues regarding the depth and duration of the lingering financial crisis. Recently, U.S. equity markets have again re-touched November 2008 bear market lows. Clearly, these negative macroeconomic factors are having an adverse impact on life insurers’ balance sheet strength and operating performance.

Over the last several months, A.M. Best has taken a number of negative rating actions in the life insurance sector, triggered primarily by investment concerns. A.M. Best expects the pace of these rating actions to accelerate as it reviews the year-end results for life and annuity companies. It is our expectation that a significant number of negative rating actions—including downgrades of issuer credit ratings (ICR) and financial strength ratings (FSR) as well as outlook revisions—will occur as a result of this review. A.M. Best has observed a number of disconcerting trends including:

* Escalating credit impairments and write-downs in investment portfolios

* High concentration of real-estate linked assets

* Significant levels of unrealized losses relative to capital

* Reduced levels of tangible equity and lower financial flexibility

* Write-offs of goodwill and DAC

* Weakened fixed charge coverage and higher financial leverage ratios

* Deterioration in earnings in core business lines

* High exposure to equity market volatility, translating into increases in variable annuity reserves and capital combined with declining fee income and assets under management

* Lower sales in certain product lines

* Higher levels of complexity in product design, capital structures and accounting treatment, which at times can mask true economic risks

* Pressure from non-insurance subsidiaries on the enterprise’s earnings and capital...

Business Wire: A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

Citigroup's road to nationalization

A push by the government to convert its stake into common stock could push Citi closer to nationalization. But what happens after will define the fate of the firm.

Citigroup may be on the verge of nationalization. But what exactly that means remains to be seen... Those concerns flared up again over the weekend amid reports that the government was thinking of taking a much bigger stake in the beleaguered banking giant.

According to the reports, the government could convert a large portion of its preferred shares into common stock, a move that would give taxpayers as much as a 40% stake in the bank...

CNN Money: Citigroup's road to nationalization

Citigroup may be on the verge of nationalization. But what exactly that means remains to be seen... Those concerns flared up again over the weekend amid reports that the government was thinking of taking a much bigger stake in the beleaguered banking giant.

According to the reports, the government could convert a large portion of its preferred shares into common stock, a move that would give taxpayers as much as a 40% stake in the bank...

CNN Money: Citigroup's road to nationalization

MetLife, AXA both place bids for AIG's life insurance unit

MetLife (MET) and AXA (AXA) both place bids for AIG's (AIG) life insurance unit. Spanning over 50 countries, the sale could mark the biggest step in AIG's dismantling, and could bring the insurer $8B-$11B...

SeekingAlpha: MetLife, AXA both place bids for AIG's life insurance unit

SeekingAlpha: MetLife, AXA both place bids for AIG's life insurance unit

Highlights of Schwab Institutional’s “Best-Managed Firms” Report

This may well be the toughest year of your career. At Financial Planning, we have heard from many of you about the strains you’re under, and how you’re reaching out to clients and staff. But as the economy continues to slow and markets continue to gyrate, life is getting tougher. This downturn doesn’t look like it will be brief—and to get through it with your business intact will likely require more from you than proactive communication. Now is the time to look inward and study your business ruthlessly—to analyze your structure, workflow, technology and staff—and figure out how to get the most out of the business you’ve got. Then, on our pages, we’ll outline steps you can take to strengthen your business, many of which cost little to no money.

Our Special Report on Practice Management (March 2009 cover story) couldn’t come at a more opportune moment...

Banking Investment Consultant: Highlights of Schwab Institutional’s “Best-Managed Firms” Report

Our Special Report on Practice Management (March 2009 cover story) couldn’t come at a more opportune moment...

Banking Investment Consultant: Highlights of Schwab Institutional’s “Best-Managed Firms” Report

First Insurance to offer prepaid cards

First Insurance Company of Hawaii customers will be able to get immediate help through a new partnership with a prepaid card program... InsurCard, a wholly owned subsidiary of Service Network Design, and First Insurance offer prepaid cards to cover eligible policyholders’ immediate needs in the event of a hurricane or other major disaster.

“We believe providing a branded card to our policyholders when they are in need will greatly simplify a very difficult situation for them. The catastrophic relief card from InsurCard gives our policyholders immediate access to make purchases and simplifies their lives when they are in turmoil,” said Ben Bondroff, vice president of First Insurance, in a statement...

Pacific Business News: First Insurance to offer prepaid cards

“We believe providing a branded card to our policyholders when they are in need will greatly simplify a very difficult situation for them. The catastrophic relief card from InsurCard gives our policyholders immediate access to make purchases and simplifies their lives when they are in turmoil,” said Ben Bondroff, vice president of First Insurance, in a statement...

Pacific Business News: First Insurance to offer prepaid cards

Monday, February 23, 2009

AIG in talks with U.S. government for more funds: source

American International Group Inc and the U.S. government are engaged in talks, as the troubled U.S. insurer faces massive losses due to writedowns on commercial real estate and other assets, according to a source and CNBC report on Monday.

AIG, once the world's largest insurer, is expected to post a loss of nearly $60 billion on Monday, when it reports its results, CNBC reported citing unnamed sources close to the company.

The talks with the government include the possibility of additional funds for the insurer and trading debt for equity, a source familiar with the matter told Reuters...

AIG in talks with U.S. government for more funds: source

AIG, once the world's largest insurer, is expected to post a loss of nearly $60 billion on Monday, when it reports its results, CNBC reported citing unnamed sources close to the company.

The talks with the government include the possibility of additional funds for the insurer and trading debt for equity, a source familiar with the matter told Reuters...

AIG in talks with U.S. government for more funds: source

Nation's Leading Expert Warns Against Purchasing Supplemental Insurance From Conseco

Less than 90 days after abandoning America's elderly, Conseco Insurance is out with a "white paper" encouraging people to buy supplemental insurance policies, says Frank N. Darras, the nation's leading disability and long-term care insurance lawyer.

Nation's Leading Expert Warns Against Purchasing Supplemental Insurance From Conseco

Source: PR Newswire

Nation's Leading Expert Warns Against Purchasing Supplemental Insurance From Conseco

Source: PR Newswire

A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

2008 was among the worst in memory for life insurers’ operating performance—the key drivers being substantial realized and unrealized losses on investment portfolios, higher costs of capital and a declining revenue base. These trends clearly are continuing and could deepen well into 2009 and beyond. A.M. Best Co.’s recently issued special report, “Life/Annuity Review & Preview 2009: U.S. Life Insurers Hunker Down As Market Turmoil Continues,” expresses the rating agency’s current perspective on the industry.

A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

Source: Business Wire

A.M. Best Special Report: Life Insurers Hunker Down as Market Turmoil Continues

Source: Business Wire

Sitting On The Sidelines: Savings Are Up. Sales of Fixed Annuities Have Skyrocketed

In the age of high-flying hedge funds and huge returns, playing it safe was the last thing on many investors' minds. Parking money in any sort of savings account, with its paltry returns, or fixed annuity just didn't seem very smart. And it certainly wasn't sexy.

Sitting On The Sidelines: Savings Are Up. Sales of Fixed Annuities Have Skyrocketed

Source: Insurance News Net

Sitting On The Sidelines: Savings Are Up. Sales of Fixed Annuities Have Skyrocketed

Source: Insurance News Net

Indie B-Ds cast wary eye on insurers

Smaller firms find it difficult to judge the financial situation of carriers

Seeking to assess the strength of the insurance carriers they do business with, many smaller independent broker-dealers — flummoxed by the insurers' opaque balance sheets and arcane accounting practices — are relying on a time-tested tool: their own observations.

They have noticed with alarm a rash of recent departures by insurance wholesalers, either due to the elimination of their jobs or through voluntary resignations, from some major carriers, including John Hancock Financial Services Inc. of Boston and The Hartford (Conn.) Financial Services Group...

InvestmentNews: Indie B-Ds cast wary eye on insurers

Seeking to assess the strength of the insurance carriers they do business with, many smaller independent broker-dealers — flummoxed by the insurers' opaque balance sheets and arcane accounting practices — are relying on a time-tested tool: their own observations.

They have noticed with alarm a rash of recent departures by insurance wholesalers, either due to the elimination of their jobs or through voluntary resignations, from some major carriers, including John Hancock Financial Services Inc. of Boston and The Hartford (Conn.) Financial Services Group...

InvestmentNews: Indie B-Ds cast wary eye on insurers

Citigroup, Bank of America: Prisoner's Dilemma, Electronic Bank Runs and Nationalization

Citigroup (C) declined 61% from a peak of $4.10 to an intraday low of $1.61 over just 10 trading days. Bluntly put: Citigroup is dead.

Bank of America (BAC) declined 64% from a peak of $7.05 to an intraday low of $2.53 over just 10 trading days. Bluntly put: Bank of America is dead.

Dead actually means dead. It is unlikely they can survive the weekend... and if they do, they most definitely cannot survive the week...

Financial Ninja: Citigroup, Bank of America: Prisoner's Dilemma, Electronic Bank Runs and Nationalization

Bank of America (BAC) declined 64% from a peak of $7.05 to an intraday low of $2.53 over just 10 trading days. Bluntly put: Bank of America is dead.

Dead actually means dead. It is unlikely they can survive the weekend... and if they do, they most definitely cannot survive the week...

Financial Ninja: Citigroup, Bank of America: Prisoner's Dilemma, Electronic Bank Runs and Nationalization

Friday, February 20, 2009

How the Mighty Banks Have Fallen

The destruction in the banking sector has been broad and deep and has taken the shares of the banking companies to lows not seen in 15, 20, or in some cases, 25 years. Bank of America Inc. shares today hit an intraday low of $3.19 a share — a level not seen since August 2, 1984, when the bank traded at $3.17 a share.

Now, the fear represents an expectation that the largest — and sickest — banks, one way or another, will be taken over by the government through some sort of temporary nationalization in order to avoid a Japan-style decade of malaise. This idea continues to gain currency, and it continues to hammer the valuation of the banks.

WSJ via Yahoo Finance: How the Mighty Banks Have Fallen

Now, the fear represents an expectation that the largest — and sickest — banks, one way or another, will be taken over by the government through some sort of temporary nationalization in order to avoid a Japan-style decade of malaise. This idea continues to gain currency, and it continues to hammer the valuation of the banks.

WSJ via Yahoo Finance: How the Mighty Banks Have Fallen

Symetra Introduces New Protector Series Life Insurance

Symetra Life Insurance Company announced today the launch of the Protector Series, term life insurance that helps protect family members from financial burden when they lose a loved one. The Protector Series features two new products, Symetra Mortgage Protector and Symetra Protector Term Life Insurance.

Symetra Introduces New Protector Series Life Insurance

Source: MarketWatch

Symetra Introduces New Protector Series Life Insurance

Source: MarketWatch

MassMutual Breast Cancer Awareness Campaign Closes with Six-Figure Donation, Greater Understanding of Importance of Financial Preparedness

Massachusetts Mutual Life Insurance Company (MassMutual) today announced that its agents' efforts to educate women about the importance of financial preparedness resulted in the company's donation of $105,000 to cancer research, prevention and treatment organizations, as well as greater awareness throughout the country in 2008.

MassMutual Breast Cancer Awareness Campaign Closes with Six-Figure Donation, Greater Understanding of Importance of Financial Preparedness

Source: PR Newswire

MassMutual Breast Cancer Awareness Campaign Closes with Six-Figure Donation, Greater Understanding of Importance of Financial Preparedness

Source: PR Newswire

Life Insurers Crushed Again

Life insurers are particularly sensitive to the stock market, partly because they sell savings and retirement products that are linked to the performance of equities.

Fitch Ratings downgraded Prudential Financial's senior unsecured debt rating to BBB from A- and its commercial paper rating to F2 from F1 on Thursday.

Life Insurers Crushed Again

Source: MarketWatch

Fitch Ratings downgraded Prudential Financial's senior unsecured debt rating to BBB from A- and its commercial paper rating to F2 from F1 on Thursday.

Life Insurers Crushed Again

Source: MarketWatch

Madoff Case - Who's Who of Whom to Sue

Release of the Madoff list is causing upheaval in the estate planning world, according to Israel Lustig, CEO of Intergenerational Wealth Preservation, Inc. (www.interwealthpres.com), a company that serves victims of Ponzi schemes and others seeking financial disaster recovery...

...Analyzing the Madoff list, Lustig points to account titles which showcase estate planning instruments that clearly failed, such as GRATs (Grantor Retained Annuity Trust), CLATs (Charitable Lead Annuity Trusts) and CRTs (Charitable Remainder Trust).

Litigators may be asking the advisors/gatekeepers some of the following questions:

·Did they disclose the risks of the estate planning structures?

·Did they plan for the contingency of a reduction in estate values?

·Did they encourage clients to avail themselves of alternate instruments or hedging techniques which may have mitigated the extent of ultimate Madoff losses realized?

·What was the objective of the GRAT: discounting the gift tax upon transfer and/or appreciating the asset out of the estate? If so, was the GRAT the only such tool available? Was it the most suitable? Was it the best tool in 2008, when Estate Tax Repeal was unsettled?

·Why didn’t the advisors factor in the possibility of decrease in asset value, when recommending GRATS in 2007 and 2008 especially the short-term GRATS?

“In fact, victims bent on recovering losses may sue any of their advisors,” Lustig states. “This includes CPAs, trusts and estates attorneys, matrimonial attorneys, corporate attorneys, and anyone who may have referred those advisors to them, such as: business managers, law firms, accounting firms, multi-family offices, private bankers, and the like. Advisors trying to use the ‘we were also duped’ defense may not find that good enough, as litigators may question why they didn’t suggest alternative tools, especially if the estate value decreased...”

NewsReleaseWire: Madoff Case - Who's Who of Whom to Sue

...Analyzing the Madoff list, Lustig points to account titles which showcase estate planning instruments that clearly failed, such as GRATs (Grantor Retained Annuity Trust), CLATs (Charitable Lead Annuity Trusts) and CRTs (Charitable Remainder Trust).

Litigators may be asking the advisors/gatekeepers some of the following questions:

·Did they disclose the risks of the estate planning structures?

·Did they plan for the contingency of a reduction in estate values?

·Did they encourage clients to avail themselves of alternate instruments or hedging techniques which may have mitigated the extent of ultimate Madoff losses realized?

·What was the objective of the GRAT: discounting the gift tax upon transfer and/or appreciating the asset out of the estate? If so, was the GRAT the only such tool available? Was it the most suitable? Was it the best tool in 2008, when Estate Tax Repeal was unsettled?

·Why didn’t the advisors factor in the possibility of decrease in asset value, when recommending GRATS in 2007 and 2008 especially the short-term GRATS?

“In fact, victims bent on recovering losses may sue any of their advisors,” Lustig states. “This includes CPAs, trusts and estates attorneys, matrimonial attorneys, corporate attorneys, and anyone who may have referred those advisors to them, such as: business managers, law firms, accounting firms, multi-family offices, private bankers, and the like. Advisors trying to use the ‘we were also duped’ defense may not find that good enough, as litigators may question why they didn’t suggest alternative tools, especially if the estate value decreased...”

NewsReleaseWire: Madoff Case - Who's Who of Whom to Sue

Source: Nationwide Mutual CEO Jurgensen fired by board

Nationwide Mutual Insurance Co held an emergency board meeting and fired Chief Executive Jerry Jurgensen, an industry source familiar with the matter said on Thursday.

Nationwide Mutual, a provider of life insurance and annuity products, on Thursday named its president and chief operating officer, Steve Rasmussen, to replace Jurgensen...

The source said it was not clear why Jurgensen was fired...

Forbes: Nationwide Mutual's Jurgensen fired by board

Nationwide Mutual, a provider of life insurance and annuity products, on Thursday named its president and chief operating officer, Steve Rasmussen, to replace Jurgensen...

The source said it was not clear why Jurgensen was fired...

Forbes: Nationwide Mutual's Jurgensen fired by board

Report: One-Fourth of Life Insurance Benefits Never Claimed

InsureMe offers strategies for finding lost insurance policies

Most people store their life insurance policy in a safe, yet accessible location: at the bank, at home under lock and key or in a safe deposit box. But what happens when the policyholder tucks documents away in a more obscure location--and neglects to tell anyone where they're hidden?

According to MissingAssets.com, an online site that aids consumers in finding missing and unclaimed property, more than one-fourth of life insurance benefits go unclaimed. This is mostly due to the fact that family members can't locate missing policies--or aren't even aware they exist...

PRweb: Report: One-Fourth of Life Insurance Benefits Never Claimed

Most people store their life insurance policy in a safe, yet accessible location: at the bank, at home under lock and key or in a safe deposit box. But what happens when the policyholder tucks documents away in a more obscure location--and neglects to tell anyone where they're hidden?

According to MissingAssets.com, an online site that aids consumers in finding missing and unclaimed property, more than one-fourth of life insurance benefits go unclaimed. This is mostly due to the fact that family members can't locate missing policies--or aren't even aware they exist...

PRweb: Report: One-Fourth of Life Insurance Benefits Never Claimed

Thursday, February 19, 2009

Insurers Continue to Face Investment Loss Concerns

Already hit hard by severe losses on their investment portfolios, insurance companies nationwide -- particularly life insurers -- continue to face challenges as they attempt to convince investors that their capital reserves are safe.

Insurers Continue to Face Investment Loss Concerns

Source: Yahoo! Finance

Insurers Continue to Face Investment Loss Concerns

Source: Yahoo! Finance

Legislators Sponsor Anti-Annuity Fraud Law

With Florida's aging population in mind, two local legislators have spearheaded an initiative that would bring harsher penalties to sellers of annuities who defraud their clients.

State Sen. Mike Bennett, R-Bradenton, and state Rep. Keith Fitzgerald, D-Sarasota, were in Tallahassee on Tuesday to announce the bi-partisan legislation that would make the practice of "twisting" a third-degree felony.

Legislators Sponsor Anti-Annuity Fraud Law

Source: Insurance News Net

State Sen. Mike Bennett, R-Bradenton, and state Rep. Keith Fitzgerald, D-Sarasota, were in Tallahassee on Tuesday to announce the bi-partisan legislation that would make the practice of "twisting" a third-degree felony.

Legislators Sponsor Anti-Annuity Fraud Law

Source: Insurance News Net

Long Term Care Insurance is Just Too Expensive

Cost is consistently one of the top two reasons given by non-LTCI buyers in every survey completed over the last decade. The other reason is that consumers are waiting for tax relief and tax-advantaged ways to purchase LTCI. In this article, I will address the non-buyers of LTCI, because they represent approximately 90 percent of your clients. To be more specific, according to a 2003 LTC Financing Strategy Group study looking at people with incomes of more than $20,000 a year, 84 percent of people aged 65 and older had not yet purchased LTCI, while 95 percent of those between the ages of 45 and 64 were not yet owners of LTCI.

Long Term Care Insurance is Just Too Expensive

Source: Producers Web

Long Term Care Insurance is Just Too Expensive

Source: Producers Web

Geico's lizard offers a new message of reassurance

For years, prosaic consumer products sought to puff up their appeal by boasting they contained "secret" ingredients that improved their performance. Colgate toothpaste had Gardol, for instance, while Dial soap had AT-7 and Certs breath mints had Retsyn.

Now, confronting consumer anxiety over the economy, the giant insurer Geico is for the first time rolling out a secret ingredient of its own: Warren Buffett. The financier controls Berkshire Hathaway, the company that has owned Geico for more than a decade...

IHT: Geico's lizard offers a new message of reassurance

Now, confronting consumer anxiety over the economy, the giant insurer Geico is for the first time rolling out a secret ingredient of its own: Warren Buffett. The financier controls Berkshire Hathaway, the company that has owned Geico for more than a decade...

IHT: Geico's lizard offers a new message of reassurance

States fight for right to regulate equity index annuities

When the Securities and Exchange Commission declared that equity index annuities are securities last year, it ignored the McCarran-Ferguson Act, which grants states the right to regulate the insurance industry, state insurance regulators and legislators told a U.S. appeals court Tuesday...

InvestmentNews: States fight for right to regulate equity index annuities

InvestmentNews: States fight for right to regulate equity index annuities

Derailed Boomers Nearing Retirement Make Seismic Changes to Their Plans

New Survey of Affluent Boomers at 60 Reveals Plans to Work Longer and Cut Spending

More than half of affluent 60-year-olds are revamping their retirement plans, double the number who reported making changes a year ago, according to the fourth annual national survey by Bell Investment Advisors of Boomers reaching this milestone age. Of those who have changed their retirement plans in the last six months, two out of three are delaying their retirement, with 34% of these planning to work an additional five or more years. Almost 75% have reduced spending, and nearly half have changed their investments.

More than half (57%) of respondents said they feel more financially stressed than they were six months ago. Three out of four (76%) said they feel less wealthy and more than a third (35%) say they do not have enough to retire. Bell Investment Advisors’ fourth annual Affluent Boomers at 60 Survey of 500 high net-worth 60-year-olds also reveals a loss of confidence in America’s financial system. These Boomers indicated they’ve lost the most confidence in government regulators (34%) and banks and financial institutions (30%)...

BusinessWire: Derailed Boomers Nearing Retirement Make Seismic Changes to Their Plans

More than half of affluent 60-year-olds are revamping their retirement plans, double the number who reported making changes a year ago, according to the fourth annual national survey by Bell Investment Advisors of Boomers reaching this milestone age. Of those who have changed their retirement plans in the last six months, two out of three are delaying their retirement, with 34% of these planning to work an additional five or more years. Almost 75% have reduced spending, and nearly half have changed their investments.

More than half (57%) of respondents said they feel more financially stressed than they were six months ago. Three out of four (76%) said they feel less wealthy and more than a third (35%) say they do not have enough to retire. Bell Investment Advisors’ fourth annual Affluent Boomers at 60 Survey of 500 high net-worth 60-year-olds also reveals a loss of confidence in America’s financial system. These Boomers indicated they’ve lost the most confidence in government regulators (34%) and banks and financial institutions (30%)...

BusinessWire: Derailed Boomers Nearing Retirement Make Seismic Changes to Their Plans

Fitch Cuts Ratings On Genworth Life Insurance Companies

Fitch Ratings said late Tuesday it downgraded the insurer financial strength ratings of Genworth Financial Inc.'s life insurance companies to A- from A+. The outlook is negative. "Today's rating action reflects Fitch's updated view of the life companies' statutory capitalization, investment exposure, and liquidity and financial flexibility, which have recently improved but may be negatively impacted by further deterioration in the financial markets," the rating agency said in a statement...

FoxBusiness: Fitch Cuts Ratings On Genworth Life Insurance Companies

FoxBusiness: Fitch Cuts Ratings On Genworth Life Insurance Companies

Wednesday, February 18, 2009

Analyst: "Nationalization" of Citi and BofA Inevitable in '09

In the past few months, an increasing number of economists have become convinced that the best "fix" for the banking system is a government takeover and restructuring of companies like Citigroup. And some voices in the government are finally supporting this idea.

Over the weekend, Senator Lindsey Graham said he thought "nationalization" has to be considered, because he doesn't want to throw good money after bad...

Yahoo Finance: Analyst: "Nationalization" of Citi and BofA Inevitable in '09

Over the weekend, Senator Lindsey Graham said he thought "nationalization" has to be considered, because he doesn't want to throw good money after bad...

Yahoo Finance: Analyst: "Nationalization" of Citi and BofA Inevitable in '09

And the Award for Hardest-to-Insure Movie of the Year Goes to...

What is the riskiest movie of this year’s crop of Oscar ® -nominated films?

According to Fireman’s Fund Insurance Company, the entertainment community’s leader in insuring films developed by Hollywood production companies, this year’s winner is perhaps an obvious choice.

Honors go to “The Wrestler,” an emotional drama about Randy “The Ram” Robinson, a once popular pro wrestling star, now aging and down on his luck, who battles both personal and health issues. As an insurance risk, the film wins “most risky production” primarily because lead actor Mickey Rourke did much of his own stunt work in the film...

INN: And the Award for Hardest-to-Insure Movie of the Year Goes to…

According to Fireman’s Fund Insurance Company, the entertainment community’s leader in insuring films developed by Hollywood production companies, this year’s winner is perhaps an obvious choice.

Honors go to “The Wrestler,” an emotional drama about Randy “The Ram” Robinson, a once popular pro wrestling star, now aging and down on his luck, who battles both personal and health issues. As an insurance risk, the film wins “most risky production” primarily because lead actor Mickey Rourke did much of his own stunt work in the film...

INN: And the Award for Hardest-to-Insure Movie of the Year Goes to…

Vanguard Applies for a GLWB Rider

Vanguard, the low-cost direct marketer of mutual funds and other financial products and services, has filed an application with the SEC for a flexible variable annuity contract with a guaranteed lifetime withdrawal benefit.

An AEGON subsidiary, the Monumental Life Insurance Company, will provide the insurance wrapper. Vanguard does not own its own insurance company. The new contract resembles Vanguard¹s existing no-load, no-surrender fee variable annuity, but with a lifetime income option.

The precise cost of the rider, which can apply to one owner or joint owners, and the payout rates at various age bands were left blank in the application, although Vanguard provided an example that set the rider cost at one percent of the income base. The minimum initial payment is $5,000 and a $25 annual fee is assessed when the account value drops below $25,000...

On Wall Street: Vanguard Applies for a GLWB Rider

An AEGON subsidiary, the Monumental Life Insurance Company, will provide the insurance wrapper. Vanguard does not own its own insurance company. The new contract resembles Vanguard¹s existing no-load, no-surrender fee variable annuity, but with a lifetime income option.

The precise cost of the rider, which can apply to one owner or joint owners, and the payout rates at various age bands were left blank in the application, although Vanguard provided an example that set the rider cost at one percent of the income base. The minimum initial payment is $5,000 and a $25 annual fee is assessed when the account value drops below $25,000...

On Wall Street: Vanguard Applies for a GLWB Rider

Microlending site now pays 5 percent

I've long been a fan of microfinance or microlending where a small loan can make a big difference. To date, I've made several small investments via both Microplace.com and Kiva.org. And, in addition to doing good, I'm doing well. Kiva doesn't pay interest but it does make it easy to give gift certificates. Microplace, in the past, paid up to 3 percent interest, but Tuesday it announced a fund that's paying 5 percent.

Have you checked bank and CD rates lately? Five percent is great compared to the rates paid by most banks and money market funds.

The money is loaned to poor people--mostly women--in various parts of the world. The portfolio that now pays 5 percent goes through an organization called Micro Credit Enterprises, which makes loans to the working poor in Armenia, Azerbaijan, Bolivia, Cambodia, Ecuador, Honduras, Indonesia, Mozambique, and other countries. And a little bit of money can go a long way. Nelida Espinoza Flores, a 38-year-old Peruvian, for example, borrowed $115, to buy Jell-O and other snacks. According to Microplace, she spends about $5 a day on supplies, which results in between $10 and $13 in sales...

CNet: Microlending site now pays 5 percent

Have you checked bank and CD rates lately? Five percent is great compared to the rates paid by most banks and money market funds.

The money is loaned to poor people--mostly women--in various parts of the world. The portfolio that now pays 5 percent goes through an organization called Micro Credit Enterprises, which makes loans to the working poor in Armenia, Azerbaijan, Bolivia, Cambodia, Ecuador, Honduras, Indonesia, Mozambique, and other countries. And a little bit of money can go a long way. Nelida Espinoza Flores, a 38-year-old Peruvian, for example, borrowed $115, to buy Jell-O and other snacks. According to Microplace, she spends about $5 a day on supplies, which results in between $10 and $13 in sales...

CNet: Microlending site now pays 5 percent

Meltdown 101: AIG, five months into its bailout

It's been five months since American International Group Inc. received its first massive cash bailout from the U.S. government, a move that put the New York-based insurer front and center in a financial crisis that was just starting to get ugly.

A lot of the early headlines about the financial meltdown contained the letters "AIG." It was the among the first companies to be questioned last year about lavish spending by executives, to cut compensation packages and to face investigations by U.S. and foreign authorities.

AP: Meltdown 101: AIG, five months into its bailout

A lot of the early headlines about the financial meltdown contained the letters "AIG." It was the among the first companies to be questioned last year about lavish spending by executives, to cut compensation packages and to face investigations by U.S. and foreign authorities.

AP: Meltdown 101: AIG, five months into its bailout

The Importance of Critical Illness Insurance During American Heart Month

According to the American Heart Association, about 1.2 million Americans suffered a first or recurrent coronary attack in 2007. Recovering from illnesses like a heart attack often present financial burdens. Money from critical illness insurance, given as a lump sum amount when someone is diagnosed with a serious illness such as a heart attack, can be used at the policyholder's discretion and provide needed protection.

The Importance of Critical Illness Insurance During American Heart Month

Source: eMaxHealth.com

The Importance of Critical Illness Insurance During American Heart Month

Source: eMaxHealth.com

Pacific Life Expands Variable Investment Options with Mid-Cap Value Portfolio & American Funds Asset Allocation Portfolio

Pacific Life recently added two new investment options to its offerings for variable universal life insurance policy owners. The addition of the Mid-Cap Value Portfolio and the American Funds Asset Allocation Portfolio expands the breadth and depth of the investment options lineup and variable life insurance policy owners can now choose from 59 investment options.

Pacific Life Expands Variable Investment Options with Mid-Cap Value Portfolio & American Funds Asset Allocation Portfolio

Source: Business Wire

Pacific Life Expands Variable Investment Options with Mid-Cap Value Portfolio & American Funds Asset Allocation Portfolio

Source: Business Wire

Prudential Financial Focus of New Website from UNITE HERE

The labor union UNITE HERE has launched www.PrudentialAnnuityAlert.info, an independent resource for broker-dealers, financial advisors and policyholders concerned about risks facing Prudential Financial and its variable annuities business. Prudential Financial, the second largest insurer in the U.S., and a market leader in variable annuities, saw the steepest decline in its risk-based capital last year and faces a unique mix of challenges that sets the insurer apart from its peers.

Prudential Financial Focus of New Website from UNITE HERE

Source: PR Newswire

Prudential Financial Focus of New Website from UNITE HERE

Source: PR Newswire

Tuesday, February 17, 2009

Ohio National Announces Record Earnings, Sales and Capital Growth

Ohio National Financial Services today announced records in earnings, sales and capital growth for 2008, including an unequalled industry record in individual life insurance sales performance... 2008 Financial Highlights:

-- GAAP equity (excluding FAS 115) was reported at $1.53 billion, an 8.7 percent increase, and representing a 10-year compound annual growth rate of 9.2 percent.

-- Pre-tax operating earnings climbed to $386.1 million, a 125.4 percent increase.

-- Net income (after tax) climbed to $146.3 million, a 26.4 percent increase...

MSNBC: Ohio National Announces Record Earnings, Sales and Capital Growth

-- GAAP equity (excluding FAS 115) was reported at $1.53 billion, an 8.7 percent increase, and representing a 10-year compound annual growth rate of 9.2 percent.

-- Pre-tax operating earnings climbed to $386.1 million, a 125.4 percent increase.

-- Net income (after tax) climbed to $146.3 million, a 26.4 percent increase...

MSNBC: Ohio National Announces Record Earnings, Sales and Capital Growth

Colonial Penn Life Insurance Company Introduces Innovative Approach to Shopping for Life Insurance With EZissuelife.com

Colonial Penn Life Insurance Company today introduced a new website for consumers, EZissuelife.com, an easy-to-understand, do-it-yourself approach to buying term and permanent whole life insurance.

Colonial Penn Life Insurance Company Introduces Innovative Approach to Shopping for Life Insurance With EZissuelife.com

Source: PR Newswire

Colonial Penn Life Insurance Company Introduces Innovative Approach to Shopping for Life Insurance With EZissuelife.com

Source: PR Newswire

Ahead of the Bell: Hartford Financial Services

Hartford Financial Services Group Inc. said Thursday it has gotten regulatory relief that will boost its capital levels and that it will no longer be eligible for a government lending program.

Ahead of the Bell: Hartford Financial Services

Source: Forbes.com

Ahead of the Bell: Hartford Financial Services

Source: Forbes.com

Variable Annuities Taking Toll on Cigna

While losses related to variable annuity products continue to take their toll on life insurance companies, they also were largely responsible for the poor fourth quarter performance by Philadelphia-based health insurer Cigna Corp., which has major operations in Bloomfield.

Variable Annuities Taking Toll on Cigna

Source: HartfordBusiness.com

Variable Annuities Taking Toll on Cigna

Source: HartfordBusiness.com

Life Insurers Enjoy Relaxed Disclosure Rules

In New York, a 1906 Anticorruption Law Requiring Names, Salaries of Many Employees Is Overturned

Amid heightened scrutiny of financial-services pay, New York legislators have removed thousands of insurance employees from under a spotlight.

An amended state law that went into effect last summer has modified what was one of the most demanding -- and some say excessive -- compensation-disclosure measures in the nation. The law, enacted in 1906 and updated over the years for inflation, had required companies to disclose the names of employees who earned more than $60,000 annually...

WSJ: Life Insurers Enjoy Relaxed Disclosure Rules (Subscription required)

Amid heightened scrutiny of financial-services pay, New York legislators have removed thousands of insurance employees from under a spotlight.

An amended state law that went into effect last summer has modified what was one of the most demanding -- and some say excessive -- compensation-disclosure measures in the nation. The law, enacted in 1906 and updated over the years for inflation, had required companies to disclose the names of employees who earned more than $60,000 annually...

WSJ: Life Insurers Enjoy Relaxed Disclosure Rules (Subscription required)

Friday, February 13, 2009

Florida insurance commission sets terms for State Farm withdrawal

Kevin McCarty, Florida insurance commissioner, conditionally approved State Farm’s withdrawal plan from the state’s property insurance market with certain stipulations.

McCarty decided not to approve the plan submitted without conditions because State Farm intended to “dump” its customers into Citizens, which was “hazardous” to policyholders and the public, McCarty said in a release...

BizJournals: Florida insurance commission sets terms for State Farm withdrawal

McCarty decided not to approve the plan submitted without conditions because State Farm intended to “dump” its customers into Citizens, which was “hazardous” to policyholders and the public, McCarty said in a release...

BizJournals: Florida insurance commission sets terms for State Farm withdrawal

Annuity Myths, Realities and Opportunities

In 2005, the Gallup Organization published a comprehensive study of more than 1,000 owners of non-qualified annuity contracts designed "to obtain a profile of the demographic characteristics of owners of non-qualified annuity contracts and to gain insight into their attitudes toward a variety of issues relating to retirement savings and security, including how they save for retirement, what they think about saving for retirement generally, what sources of funds they used to purchase their annuity contracts, the reasons why they bought them, and how they plan to use them." The Committee of Annuity Insurers, Survey of Owners of Non-Qualified Annuity Contracts.

Annuity Myths, Realities and Opportunities

Source: Producers Web

Annuity Myths, Realities and Opportunities

Source: Producers Web

AXA Equitable Launches Online Beneficiary Resource Center

AXA Equitable Life Insurance Company announced today the launch of its new online Beneficiary Resource Center. In one, easy-to-navigate site, the Beneficiary Resource Center offers the forms, tools, and guidance for beneficiaries and financial professionals to quickly and easily file a life insurance or annuity claim. The site also serves as a portal for information, checklists, and contacts to support beneficiaries through what can be an overwhelming period and to help them prepare for the next stage in their lives.

AXA Equitable Launches Online Beneficiary Resource Center

Source: PR Newswire

AXA Equitable Launches Online Beneficiary Resource Center

Source: PR Newswire

Financial Crisis? Here's How It's Your Opportunity

It’s tempting to think that the economic downturn is like the weather: everybody’s talking about it, but nobody’s been able to change it.

I don’t agree. While I’ve never seen anything like this recession during my career, I believe we in the insurance industry have a unique opportunity during this economic crisis. It’s a good time to assess what’s working and to confirm the value that we as professionals (and our organizations) provide in the marketplace.

Financial Crisis? Here's How It's Your Opportunity

Source: Life Insurance Selling

I don’t agree. While I’ve never seen anything like this recession during my career, I believe we in the insurance industry have a unique opportunity during this economic crisis. It’s a good time to assess what’s working and to confirm the value that we as professionals (and our organizations) provide in the marketplace.

Financial Crisis? Here's How It's Your Opportunity

Source: Life Insurance Selling

Insurers Seek Relaxed Capital Rules That Hartford Won

Hartford Financial Services Group (HIG) became the first major life insurer to receive approval from its state regulator to make use of controversial statutory accounting practices that will boost its surplus capital by around $1 billion.

It won't be the last.

"Quite a few" life insurers have made similar requests to their state regulators, and decisions should start coming soon, said Commissioner Thomas E. Hampton of the D.C. Department of Insurance, Securities and Banking, in an interview with Dow Jones Newswires Thursday...

CNN: Insurers Seek Relaxed Capital Rules That Hartford Won

It won't be the last.

"Quite a few" life insurers have made similar requests to their state regulators, and decisions should start coming soon, said Commissioner Thomas E. Hampton of the D.C. Department of Insurance, Securities and Banking, in an interview with Dow Jones Newswires Thursday...

CNN: Insurers Seek Relaxed Capital Rules That Hartford Won

Great-West Lifeco Swings to 4Q Net Loss on Charge at Putnam Investments

Canada's Great-West Lifeco swung to a fourth-quarter net loss on a big charge at its U.S.-based Putnam Investments unit.

Net loss amounted to C$907 million (US$728 million). Great-West Lifeco said it recorded a C$1.3 billion non-cash impairment charge related to Putnam goodwill and intangible assets. The charge mostly reflected the significant deterioration in financial markets since the company acquired it in August 2007, Great-West Lifeco said...

TradingMarkets: Great-West Lifeco Swings to 4Q Net Loss on Charge at Putnam Investments

Net loss amounted to C$907 million (US$728 million). Great-West Lifeco said it recorded a C$1.3 billion non-cash impairment charge related to Putnam goodwill and intangible assets. The charge mostly reflected the significant deterioration in financial markets since the company acquired it in August 2007, Great-West Lifeco said...

TradingMarkets: Great-West Lifeco Swings to 4Q Net Loss on Charge at Putnam Investments

Hartford loses access to U.S. lending facility, shares plunge

Hartford Financial Services Group Inc lost access to a U.S. commercial paper lending facility after recent debt rating downgrades, it said in a regulatory filing, and shares dropped 11 percent.

In the filing on Thursday with the U.S. Securities and Exchange Commission, Hartford (HIG.N), a large life and property insurer, said it will have to repay the $375 million borrowed under a federal program...

Reuters: Hartford loses access to U.S. lending facility, shares plunge

In the filing on Thursday with the U.S. Securities and Exchange Commission, Hartford (HIG.N), a large life and property insurer, said it will have to repay the $375 million borrowed under a federal program...

Reuters: Hartford loses access to U.S. lending facility, shares plunge

Thursday, February 12, 2009

Don’t Let Good Service Drain Your Staff

Today’s complex life insurance products, variable, indexed, or universal, are not just sold once, but over and over again through policy management and customer service. Overlooking just one detail can have a significant impact on the performance of a client’s policy. As producers, we are challenged to balance good service with overhead costs. How, then, can we provide great service without draining our staff’s time, and still have time to bring on new clients?

Don’t Let Good Service Drain Your Staff

Source: Life Insurance Selling

Don’t Let Good Service Drain Your Staff

Source: Life Insurance Selling

Serving Middle Income Customers Through Financial Institutions

Most life insurance companies have been more talk than action when it comes to effectively providing middle income households with the life insurance protection they need. Similarly, life insurance companies have experienced a relative lack of success when trying to reach this segment via banks and credit unions.

Serving Middle Income Customers Through Financial Institutions

Source: National Underwriter (subscription required)

Serving Middle Income Customers Through Financial Institutions

Source: National Underwriter (subscription required)

GM Making Cuts to Life Insurance, Health Care

General Motors will reduce life insurance benefits for most of its white-collar retirees and cut back on company-provided health care for some salaried workers under 65, according to the Detroit Free Press.

GM Making Cuts to Life Insurance, Health Care

Source: Wxyz.com

GM Making Cuts to Life Insurance, Health Care

Source: Wxyz.com

Annuities Hedging Not Cut, Dried

Niaz Haider, senior v.p. and head of structured fund products for the Americas at HSBC, has warned variable annuities issuers to ensure their risk managers work closely with product structurers so they don’t give investors so much choice that hedging becomes too difficult...

iiDerivatives: Annuities Hedging Not Cut, Dried

iiDerivatives: Annuities Hedging Not Cut, Dried

Wednesday, February 11, 2009

John Hancock Launches New Accumulation Universal Life Insurance Product

John Hancock Life Insurance today announced the launch of its new Accumulation UL product, a universal life policy that offers outstanding cash accumulation potential to address varying financial needs.

John Hancock Launches New Accumulation Universal Life Insurance Product

Source: PR Newswire

John Hancock Launches New Accumulation Universal Life Insurance Product

Source: PR Newswire

Life Insurance Stocks Fall on Rating Woes

U.S. life insurer shares fell sharply on Tuesday as investment losses triggered rating agency concerns.

Late Monday, Fitch downgraded the insurer financial strength rating for Hartford Financial Services Group Inc's primary life insurance subsidiary, citing the company's "exposure to the currently volatile credit and investment market conditions."

Life Insurance Stocks Fall on Rating Woes

Source: Yahoo! Finance

Late Monday, Fitch downgraded the insurer financial strength rating for Hartford Financial Services Group Inc's primary life insurance subsidiary, citing the company's "exposure to the currently volatile credit and investment market conditions."

Life Insurance Stocks Fall on Rating Woes

Source: Yahoo! Finance

Generation-X Feels Unprepared for Long-Term Care Costs and the Future, Survey Finds

Many members of Generation-X say they feel unprepared for long-term care and do not feel they are taking the necessary steps to prepare for their futures, according to a survey released today by America's Health Insurance Plans (AHIP). The survey, conducted by StrategyOne on behalf of AHIP, found that over half (52 percent) of respondents born between 1960 and 1980 feel somewhat or entirely unprepared for long-term care. They also place more immediate financial concerns ahead of affording long-term care, with 44 percent of respondents ranking the need to save for retirement as their first or second priority.

Generation-X Feels Unprepared for Long-Term Care Costs and the Future, Survey Finds

Source: PR Newswire

Generation-X Feels Unprepared for Long-Term Care Costs and the Future, Survey Finds

Source: PR Newswire

MetLife Redesigns Web Site

New site features simpler navigation, better search capabilities and new account management tools, among other features, according to the insurer.

MetLife has launched a redesign of its principle Web site to provide users with simpler sit navigation, easier access to information, new account management tools, more robust content, and improved search capabilities, according to the New York-based insurance carrier.